Project Setup

DebtBusters operates from a centralised office in Cape Town, South Africa, from which more than 350 employees service clients nationally. DebtBusters’ purpose is to reach out to all, lift the burden of debt and protect their client’ future. To date, DebtBusters has assisted more than 75,000 South Africans, providing each with excellent customer service and solutions tailored to meet their individual needs. DebtBusters prides itself on being a key player in shaping the development of the industry and this is helped by its extensive relationships with credit providers, its innovative approach to business and its continual investment in data, analytics and technology. Smartcents, a personalised self-help web portal, was developed for Debtbusters’ clients in 2014 to offer them a more transparent way of viewing their debt counselling progress.

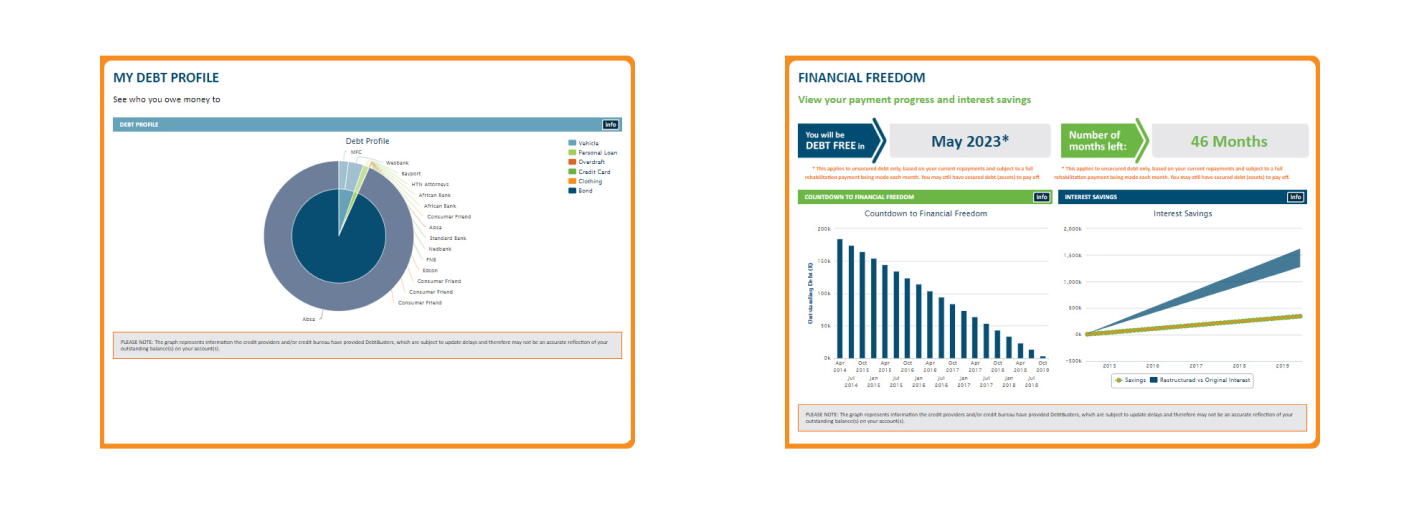

Smartcents allows them to:

- View the progress of their debt counselling journey, and obtain detailed information on each stage in the process

- Download legal and other documents relating to debt counselling

- View educational content through newsletters, infographics, magazines and videos

- Check their account balances and payment history and credit report

- Sign up for value-added products such as Credit Life Cover, Funeral Cover and Life Insurance Cover

- Log queries directly via the website though "contact us" button or chat function

The Challenge

With the amendments to the National Credit Act (NCA) in 2016, the courts started accepting digitally signed contracts which opened the opportunity for DebtBusters to engage with WARP Development to help them build a digital sign up process on the Smartcents platform. This would allow them to extend the philosophy of transparent financial information to potential clients.

This digital sign-up process had 3 main components:

- Build a digital calculator that allowed a financial consultant to capture budgetary information from a potential client to determine whether the applicant was over-indebted or not.

- Push relevant information to Smartcents so that the potential client could view the results of the assessment in real time, in a way that was simple, visual and easy to understand.

- Enable the potential client to sign the contract digitally and upload relevant supporting documents.

The Solution

Smartcents was rolled out to DebtBusters’ financial consultants in early 2017, to use as a digital acquisition channel. Potential clients can apply digitally using either a PC or a mobile device, as an alternative to printing, signing, scanning and emailing their application.

- DebtBusters' financial consultants rapidly adopted this platform and within 6 months were channeling the majority of 97% of potential clients through Smartcents.

- Currently 52% of Debtbusters' clients choose to apply digitally via Smartcents with the number growing quarter on quarter, and an additional 38% will log-on after application to use Smartcents as a client service focused portal.

- The average turn-around time from speaking to a potential client, to them returning a completed application, reduced from over 4 business days prior to introducing a digital option to less than 2 business days.

Project Results

97%

of new potential clients use Smartcents

52%

of IDM's clients choose Smartcents

2 business days

turn-around time decreased from 4 to 2 business days

Ready to future-proof your business?

Let us help you build the technology solution your business needs for a scalable future.